Tax Return & Refund Eligibility Checker

Few more Steps and you're all set!

you're Almost there!

You're One Step Away From Your Tax Refund!

one Last step to know about your eligibility

Every step counts keep going!

You're halfway done stay on track!

one more step and know about your eligibility

You've made it! Just one last click.

You may need to complete a tax return if you have additional income, are self-employed, or have received a request from HMRC. Answering this helps determine your tax obligations.

To be able to claim for travelling for work, you must travel to at least 2 or more temporary locations for work purposes. We will also require proof in the form of a work contract that states you may need to travel to temporary locations. We will not be able to help you claim otherwise.

Please select the one industry you have worked in for most of the tax year (if multiple apply) This will help us to assess whether you have a claim or not. Or if you are required to complete a tax return.

You may need to complete a tax return if you have additional income, are self-employed, or have received a request from HMRC. Answering this helps determine your tax obligations.

This refers to your basic Training, also known as Phase 1 Training, which is the first step on your Army journey and is a 13-week course.

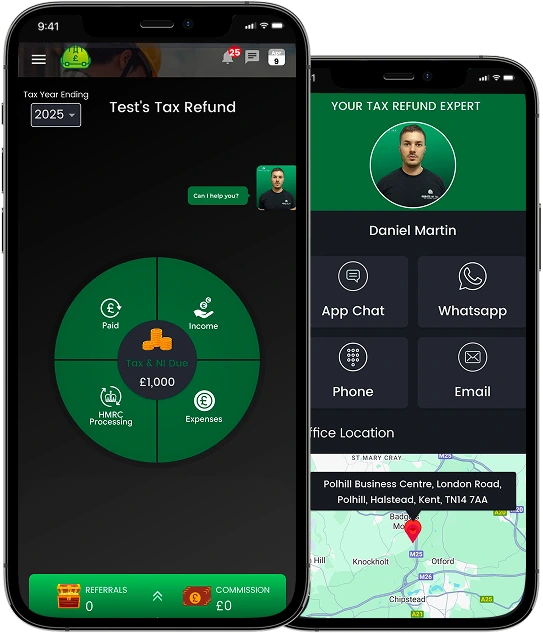

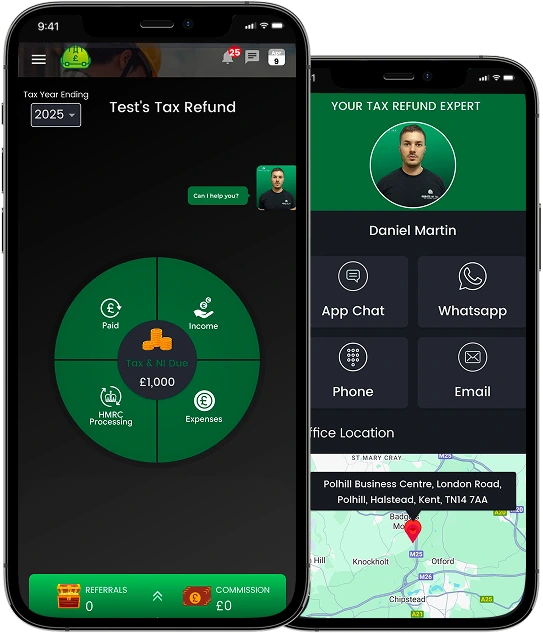

Our Tax Refund app streamlines tax rebates and self-assessment. Track income, expenses, and refunds, generate invoices with PayPal, and get payouts in 72 hours.

Already Have an Account? Log in

Download Our AppYou may need to complete a tax return if you have additional income, are self-employed, or have received a request from HMRC. Answering this helps determine your tax obligations.

Our Tax Refund app streamlines tax rebates and self-assessment. Track income, expenses, and refunds, generate invoices with PayPal, and get payouts in 72 hours.

Already Have an Account? Log in

Download Our AppIf your contractor deducts 20% tax (or 30% in some cases) from your pay, then this is typically CIS Tax (Construction Industry Tax).

If you’re part of the Armed Forces community, you can claim back tax for your travel expenses on temporary postings of 24 months or less.

If you had to pay to use your own vehicle or public transport and weren't reimbursed by your employer you could claim a tax refund on those costs.

You may need to complete a tax return if you have additional income, are self-employed, or have received a request from HMRC. Answering this helps determine your tax obligations.

(Tools / Clothing / PPE / Food & Overnight Stays / Other Work Related Expenses)

To be able to claim for travelling for work, you must travel to at least 2 or more temporary locations for work purposes. We will also require proof in the form of a work contract that states you may need to travel to temporary locations. We will not be able to help you claim otherwise.

Why Choose Rebate My Tax?

A Simple Process

Download Free App and register account

Add any proof of income you might have & complete a simple expenses form.

You can have your Tax refund payment within 72 Hours

Our Blogs

Services we offer

Rebate My Tax provides a fast, hassle-free, tax refund service for any employed or self-employed individual. We also offer many other tax advisory services.

Why choose us to manage your Tax?

We guarantee to get you back a bigger refund than anywhere else

We can find all your pay and tax info, so you don’t have to

Get your Tax Refund within 72 hours of submission

We will let our stats do the talking